Renters Insurance in and around Lenoir

Renters of Lenoir, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or space, renters insurance can be a good idea to protect your personal property, including your video games, boots, linens, coffee maker, and more.

Renters of Lenoir, State Farm can cover you

Renters insurance can help protect your belongings

There's No Place Like Home

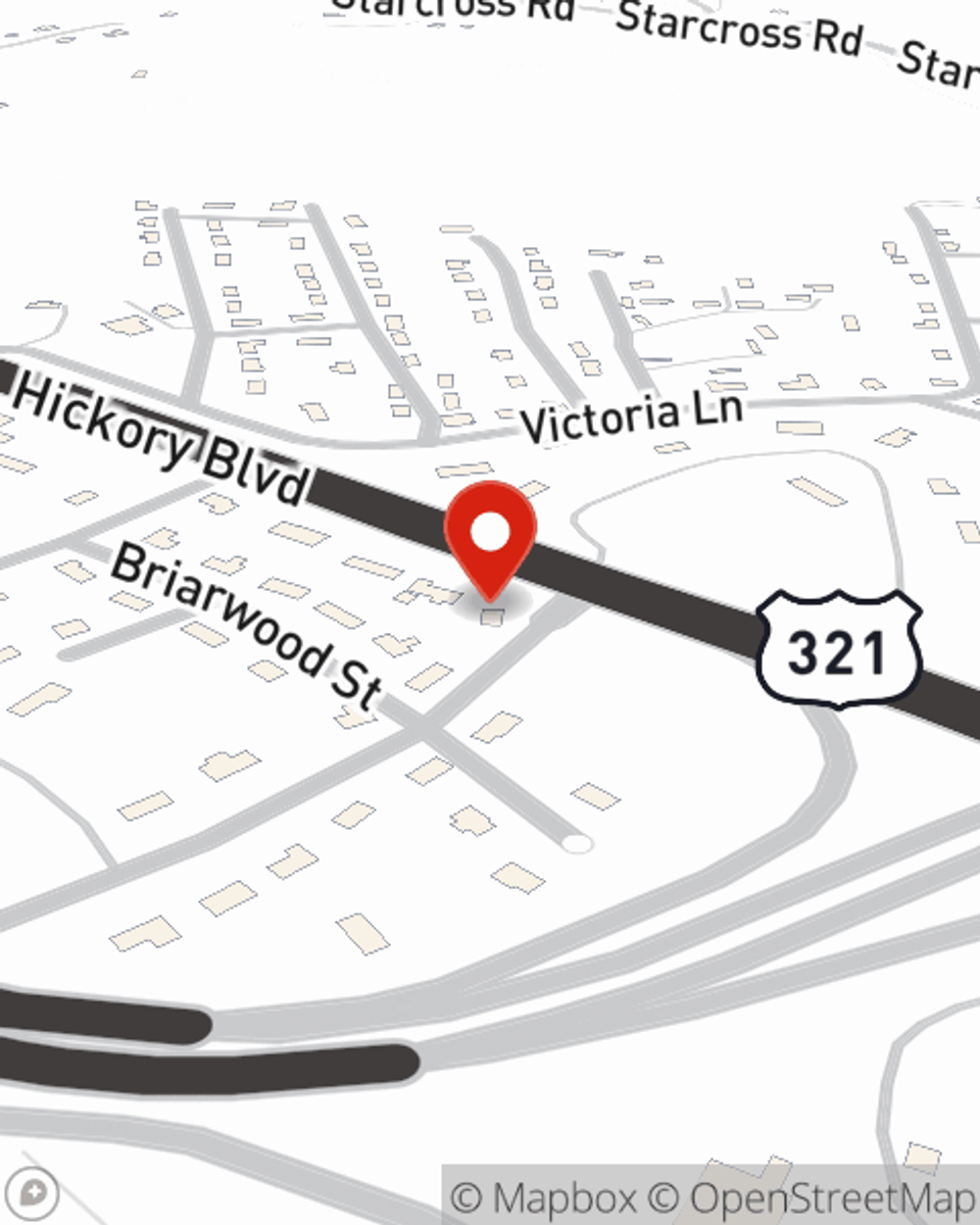

When renting makes the most sense for you, State Farm can help guard what you do own. State Farm agent Sam Morgan can help you develop a policy for when the unanticipated, like a water leak or an accident, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Lenoir renters, are you ready to talk about the advantages of choosing State Farm? Contact State Farm Agent Sam Morgan today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Sam at (828) 394-3088 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.